To run a successful business it is crucial to understand your CAC (customer acquisition cost), LTV (customer lifetime value), and why these metrics are so important to the success of the company. Two of the most important KPIs (key performance indicators) used today in nearly any business that is growing, or planning to grow are CAC and LTV. CAC and LTV are frequently used as measurements for success across a variety of departments.

When all departments understand that it is five times more expensive to acquire a new customer than it is to keep an existing customer, they will see why it is so important to focus on improving the LTV and improving the company’s LTV/CAC ratio. As the lifetime value of customers increases the company is then able to spend more on marketing, new products, and feature enhancements to acquire new customers and fuel massive growth.

Customer Success and Customer Service teams play a pivotal role in influencing the customer lifetime value through the service they provide. Providing excellent customer support can dramatically increase customer retention rate and brand loyalty, which directly impacts the LTV, and may even directly impact the CAC because loyal customers are more likely to refer your company.

Another powerful way to increase the LTV of your customers is through upselling. Support teams regularly communicate with customers and since it is far easier and much more profitable to upsell an existing customer than it is to convert a new customer, support teams often have this goal incorporated into their KPIs which has a direct and measurable impact on LTV. Understanding the details of CAC, LTV, the LTV/CAC ratio, and how these metrics can apply across customer success and your organization as a whole will help you to understand why keeping customers happy and providing them with new solutions is so crucial to your company.

Customer Acquisition Cost (CAC)

The Customer Acquisition Cost (CAC) measures the cost of converting a visitor into a lead, and then into a paying customer through the marketing funnel. CAC is significant because knowing the cost of acquiring a single customer can help inform investors, forecast financial projections, and assist with resource and budget allocations.

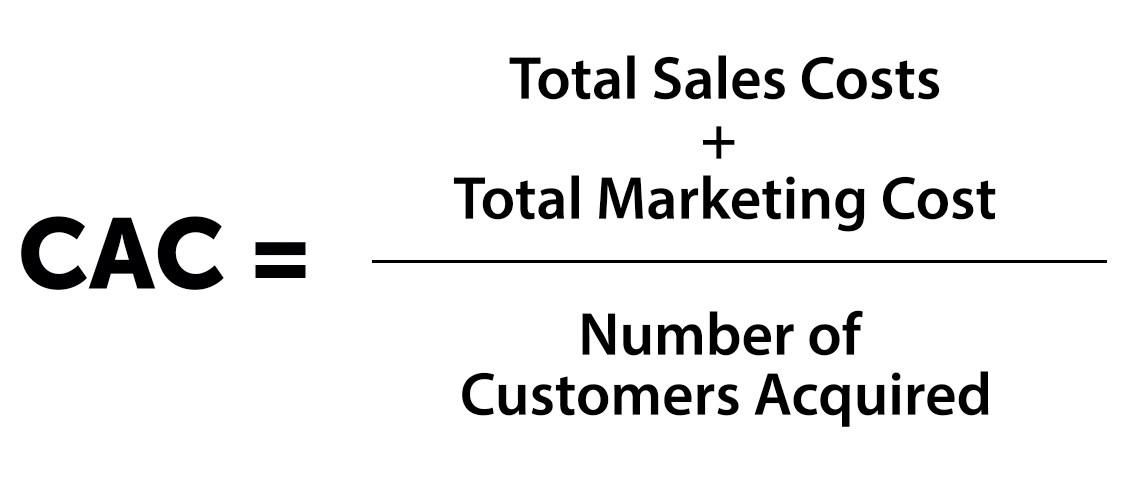

To calculate CAC, simply divide your total sales and marketing costs for a particular campaign by the number of users generated.

CAC = (Total Sales & Marketing Cost)/(Number of Customers Acquired)

Some companies may use a blended CAC, which takes the total combined cost for all marketing channels, or the costs for an entire department or company, divided by the total number of customers acquired by all marketing channels, the department, or the company. Others will break each CAC down to the spend from an individual campaign. Beware of using a blended CAC since it can lead to investing in unprofitable channels, and staffing. If you combine all marketing channels or departments then the truth could be that one channel or department could be responsible for 90% of the new customers, but only allocated 10% of the budget and resources, while another department could be allocated 90% of the budget and resources, but only drive 10% of new customer growth. In the latter example, the CAC could be completely unprofitable and lose money, wasting resources for the company at a very fast rate. It is more prudent to use a hybrid approach where fixed and variable costs are combined for each marketing channel, event, or campaign. In this scenario one would combine the following costs for a department or campaign:

- Staff Costs (estimating a percentage of each staff member’s salary)

- Ad spend

- Agency costs

- Designer costs

- Other department or campaign costs related to the customer acquisition

When the total fixed and variable costs are calculated for a set time, then take the sum of these costs and divide by the number of customers acquired within the same period. This will produce the most realistic picture of a campaign’s CAC.

Having an accurate Customer Acquisition Cost gives sales, marketing, finance, and operations an idea of how many customers convert for a set dollar amount, as well as insights into the top-performing marketing channels, campaigns, and even departments. The lower your CAC, the better a particular campaign or channel is performing. The best campaigns and marketing channels can then be selected to funnel additional marketing dollars into.

Customer Acquisition Cost can be a fluid metric and change over time, especially if new processes, products, channels, or campaigns are launched. As a best practice select which data points your organization will track to measure CAC, then report at a set time interval (weekly, monthly, quarterly) to track trends. Over time, it can be useful to segment CAC by country, type of campaign, age of the customer, and other data to target the most cost-efficient way to convert customers.

Customer Lifetime Value (LTV)

While CAC can be invaluable when informing sales and marketing decisions, combining CAC measurements with Customer Lifetime Value (LTV) provides valuable insights that are actionable across the entire organization. Customer Lifetime Value (LTV) is the total amount a customer will spend on your brand over time. To calculate, multiply the average annual revenue from a customer over a period of time by the average length of a customer. The timeframe is usually broken down by years, but could be months or quarters depending on the business. The more data points used for this mean value, the more accurate it will be.

LTV = (Annual revenue per customer) x (Average length of a customer)

What you’re left with is the average value that each new customer will bring to your business. Once your organization calculates a standardized LTV you can further segment your customer base and find the LTV of various types of customers, discovering which customer segment is of the highest monetary value to your brand. You might find that for instance, customers that work in education or healthcare are the best and most valuable, it may be worth developing additional customer support resources (such as in-depth knowledge base articles), products, or services for these customers.

LTV/CAC Ratio

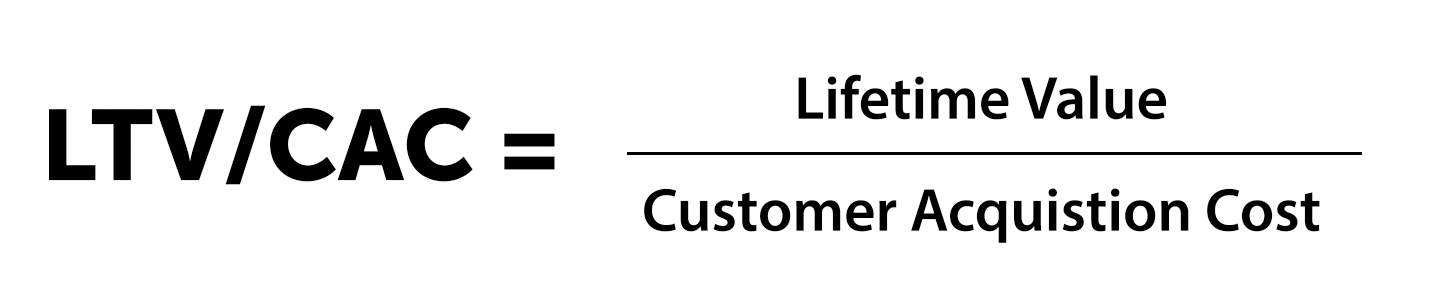

Having computed CAC and LTV, brands can produce an extremely valuable metric across the entire organization, the LTV/CAC Acquisition Ratio. To calculate this ratio simply divide the average CAC of acquiring a customer by the average LTV.

LTV/CAC Ratio = Lifetime Value / Customer Acquistion Cost

By dividing the LTV of $100 by the CAC of $20, there is a ratio of 5.0x or 500%. Most businesses strive for an acquisition ratio of at least 3x, and as a baseline, a brand’s Customer Acquisition Cost should be at least three times the overall lifetime value of their customer. Other variables can come into play to determine if this LTV/CAC ratio is appropriate for your company, such as how long the average lifetime of a customer is. If you are a very new company the lifetime of your customers is quite short, so as the company becomes more established over time it is appropriate to assume that the lifetime value of a customer will continue to steadily increase over time. Similarly, if a company has been in business for decades then the LTV of a customer might be overinflated and it might be more appropriate to limit the LTV to a more reasonable timeframe.

Why the LTV/CAC Acquisition Ratio is Important to Every Department

While the majority of the CAC is influenced by sales and marketing teams, there may be ways other departments can influence this metric. One example could be if every customer service representative sent a follow-up email to a customer after they closed a ticket, giving them a special referral code where they could get a $10 gift card if they referred a colleague or friend to the company. If an existing customer referred a new customer because of their positive customer service experience to get a $10 gift card, and the average CAC was $20 this would impact the overall LTV/CAC ratio.

That said, sales and marketing are still in the best position to influence the CAC, while an entire organization can impact the LTV and therefore the LTV/CAC acquisition ratio. For example, engineers and product teams can positively influence LTV by creating high-quality products, features, or enhancements that new and existing customers love. Finance teams can rely on the LTV/CAC ratio to forecast company profits, measure financial health, and make resource allocation decisions to further improve the LTV/CAC ratio.

Customer success teams play an integral role in the LTV/CAC ratio by serving as the key influencers at the company because they are in contact with existing customers daily. Customer support representatives play one of the largest roles by directly influencing an existing customer’s sentiment, which directly impacts the LTV and how happy the customer is with the product or service and the company as a whole. A mere 5% increase in customer retention can increase revenue by a minimum of 25%. Once a lead converts to a paying customer, customer success teams can dramatically increase LTV and improve the acquisition ratio through high-quality customer service.

Customer service teams are also frequently tasked with upselling existing customers, which is one of the simplest ways to increase Customer Lifetime Value. If a customer is having a problem that can be solved by adding another product, paid feature, or higher tier plan, then this upsell instantly affects the LTV of that customer and the overall LTV/CAC ratio. In addition, if a customer calls in to cancel their account and the customer service member can keep them as a customer, that also directly impacts the LTV of that customer and the LTV/CAC ratio.

CAC, LTV, and the LTV/CAC ratio are key metrics that should be aligned across all departments of an organization. Different departments can impact the company’s CAC and LTV and the LTV/CAC ratio, which reflects the performance and customer health of your brand as a whole. Setting clear goals for each department that will improve the LTV/CAC ratio will ultimately make the company more profitable and successful and fuel customers as brand advocates. By empowering teams to regularly collaborate across teams around the company’s CAC and LTV, some of the most creative and successful ideas can be born.